Aggregators and "What I Do Best"

Two Stories

Two stories to start the day. The first is a sad continuation of US gun culture. Again, this is not a critique of guns in general, but instead of irresponsible gun owners. If you do own a gun, please take some time to recognize that being responsible and respectful of the weapon you possess is an essential part of ownership. There are a lot of good reasons to own a gun (while I don’t, I understand the reasons). So please, lead by example. Whether you enjoy shooting for the craft, to hunt, or self-defense, take the time to recognize the power of what you own and treat it as such. Please.

The second story provides a great counter example to the first. Keanu Reeves is exactly the person we need to uplift our spirits. While finding “feel good” stories about Keanu seems pretty easy, there was a story this weekend about him interacting with kid who was asking questions. How did he handle it? By answering the questions and then, importantly, asking the kid a few more questions.

So, thank you to Keanu for taking the time to interact with people who reach out.

More importantly, thank you to the TON of you out there doing your part to make the world a better place. The gun story is going to get a lot more press, but the story of everyone out there doing their part to make the world better is going to get overlooked…and it shouldn’t. Thank you!

Polling Update

Just for those that are curious, the polling did seem to work. There weren’t many responses (12 overall) and here are the results:

Kudos to the two of you that went with the first answer! Now I need to think about some useful ways to incorporate it.

Two Quotes That Deserve Some Attention

The first quote is here

The second quote is here

Interestingly, both quotes appeared within about 30 minutes of each other, but both tied to an interesting theme. One that I’m going to follow-up on in a bit with a question from LibertyRPF’s substack. However, before that, let me address both of these. If you’ve been reading my column for awhile, you probably have figured out that I’m not offering up any “new” information.1 Instead, I’m repeating information that I have learned over the years. In other words, I’m far more of an aggregator than a developer.

What exactly does an aggregator do? Well, according to this page, we produce 2.5 QUINTILLION bytes of data every day. This site suggests that there are “more than 600 million blogs on the internet, with over 7.5 million blog posts published per day in 2022.” 7.5 MILLION PUBLISHED PER DAY!!! I don’t know about you, but I probably would find it hard to read 7.5 million blog posts each day.

Therefore, we need people (aka aggregrators) to figure out what things may be relevant and discuss it. In addition, they hopefully will be adding some insights to help make that knowledge part of your toolkit going forward. If they do this, while managing to keep you entertained (you have to be able to tell a story well), they will gain some traction and continue. If not, they will either keep writing (because they enjoy it) or lose interest and disappear.

In other words, look for more types of information that you can find in other sources. The advantage I have is time, which allows me to focus on what I think is relevant and pass it along. Hopefully, I can spin a little better story than the average textbook author (a nice low bar) and provide some level of information (mostly) with a few bad attempts at humor.

LibertyRPF Asks a Question

One of the sites that I read regularly is Liberty’s Highlights. On Monday, he asked three questions which I thought were interesting and would be worthwhile to address here. First, the questions:

So, let me attempt my answers below.

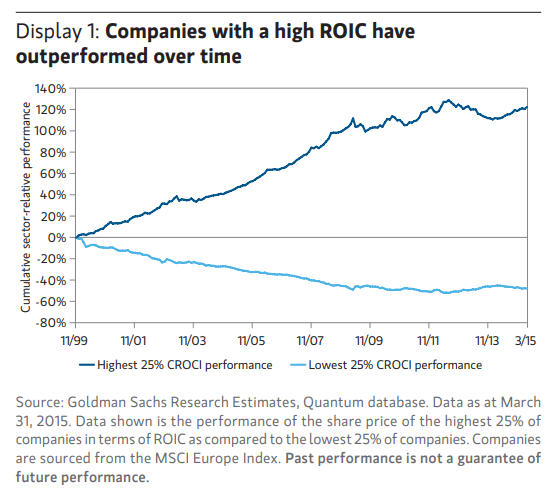

What I do best is teaching. More specifically impart complex topics in a relatively simple format. Sometimes this is relatively easy like introducing a financial ratio such Return on Invested Capital = NOPAT/Investing Capital. If ROIC is greater than your Weighted Average Cost of Capital, this is good. If not…not so much.

It sounds simple (and it is), until you get into the important part. As an investor, your goal is not to tell me what ROIC has been, but to project what it is going to be going forward. Also, you need to do the same with the firm’s WACC.

Unfortunately, this means you need to check your magic 8 ball because what happened to the firm over the past few years does not tell us what IS going to happen to the firm over the next few years. Also, if your ROIC is 13% and your WACC is 7%, that is good. What about if it is 15% and the WACC is 7%. That’s better, right? Okay, so how much “value” does it add? Is it 15% and heading down while the 13% is heading up? Being able to calculate the ROIC is relatively easy, but not meaningful.

Being able to interpret your calculation is far more meaningful, but now you need to explain they “why” behind your reasoning. This is the hard part because, unfortunately, there is not a “correct” answer. Instead it is a question of how you build your case and what story you are trying to tell.

Consider the example mentioned by Vince Martin of Overlooked Alpha

Since 1948, Real GDP has grown over 10% in one single year (10.56% in 1951) and now it is going to grow by 30-50%? Granted, she didn’t say REAL GDP, so maybe she was referring to nominal GDP (in which case it has grown by more than 10.56%, but mainly in inflationary times…maybe she is predicting that inflation will grow between 20-40% and real growth will be 10%).2 Technically, it is possible, just highly improbable.

So, take the time to think about what story you are trying to tell and whether or not it makes sense.

That said, the key to teaching is

Explain the concept and work through an example

Explain the flaws of the concept

Explain how to use the concept as part of your overall analysis

Answer questions

This is true for something as simple as a financial ratio or as complex as a delta-neutral hedging position. Too many teachers explain the concepts and work through an example, and typically stop there. This is a half-assed way to teach. If you aren’t going through the rest, such as “what can go wrong on a delta-neutral hedging position” and how would you apply the concept in a real world scenario, you aren’t really teaching the concept.

How good am I at teaching? I’m going to cheat and not answer that question. I’m good at it, but the main reason is because I am far more interested in steps 2-4 rather than step 1. Do I get all the flaws? Probably not…I’m sure there are more out there beyond what I see (or may be too technical for the course). However, I spend time to address most of them (especially as I moved to higher level courses such as Investments I/II compared to Business Finance) that I saw and talked about how to apply the concept. I enjoyed answering questions (although less the “is this going to be on the test” and more of the “how do you see X impacting Y”) that involved thinking.

If I had to get better at it, how would I accomplish that? This is a hard one because I don’t really have an answer. Some of you were my former students and I’m always up for suggestions. Teaching is a big part of why I write this substack and make occassional YouTube videos, but that is more of a part-time hobby.

The biggest thing though (which I started doing more over the past 5-10 years of teaching) is bringing in other topics. I like to think of this as the David Epstein “Range” type of approach.

When I taught an MBA class, I’d incorporate Freakonomics, TED Talks, etc. on leadership, compensation, ethics, etc. where students would read the article (or listen to the podcast) and then write about it in an interactive online forum. That was a start as it forced students to read something outside the textbook, but gave them flexibility in what they were reading.

Over the last two years that I taught, I would buy students a copy of Range and had them read and post about it (ten posts were expected). It had nothing really to do with “finance” (although the kind vs. wicked learning environments tied in REALLY well to finance), but the idea of sampling careers, analogies, etc. were (hopefully) very productive to students wanting to become MBAs. A big part of that is that someone pursuing an MBA is likely going to end up in a leadership position (regardless of the specific field they go into). Therefore, they need to understand what leads to better decisions.

We still did valuation, cost of capital, time value of money, etc., but I wanted to expand the course to get them to think about how things relate to each other. More of this would be good.

What is preventing me from putting that plan into practice right now? Retirement!

Here’s the problem. I’m going to be 54 in under 2 months. That is still too young to be retired, but honestly I see it as giving me 15-20 years of “active” life left (times where I can do things without worrying about whether the wheels are going to fall off). Granted, there is a margin of error there as you can always get hit by a bus or hit 75 and still be active. That said, the average 65-75 year old is not looking too spry. Years take their toll whether we want them to or not. One of my favorite quotes (the attribution is questionable) belongs to Mark Twain (as do seemingly half the quotes out there). It goes like this (along with my follow-up):

"Twenty years from now you will be more disappointed by the things that you didn't do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover." -- (allegedly) Mark Twain

"Twenty years goes by quicker than you'd think." -- Me

I like to run. There are trails that I want to get out and explore through hiking/backpacking. The US has a lot of things that I want to see (sorry, not an international traveler). So far, I’m able to run, but there is a limited amount of time to do everything we want.

Morgan Housel sums it up greatly with this quote

These definitions are my own, but here’s the distinction: Rich means you have cash to buy stuff. Wealth means you have unspent savings and investments that provide some level of intangible and lasting pleasure – independence, autonomy, controlling your time, and doing what you want to do, when you want to do it, with whom you want to do it with, for as long as you want to do it for.

I’m at the stage were my wealth is enough that I can do what I want (which is not to say we’re rich…we still are pretty careful on the spending front).

Other people are wired differently. LeBron James (and more power to him) has far more riches than he could spend, but still appears in commercials selling crypto and Hummers. However, the difference is that he is doing what gives HIM "some level of intangible and lasting pleasure”. This is great as we need people like that.

Unfortunately (or I should say "Fortunately”), I’d prefer to relax, read, go backpacking, travel to see Redwood National Park, the fall leaves in Minnesota, etc. Therefore, let retirement continue!

I was going to say that I’m sorry for any brain damage that I have caused, but hey, no one is actually making you read these so you are equally responsible. 🤣

Well, ARKK did see a mere $1.5 billion in NET inflows for the year.

Great answer, thanks Kevin! 💚 🥃