The highlights of a career in academics include getting to serve on committees, fill out annual accomplishment reports, and spend time grading term papers. HA! I kid…those are NOT the highlights. Instead, one of the real highlights is when you see a student that was in your class go on to do something special in his/her life. That can range from being a great father/mother, making a contribution to society outside of their career, knocking the ball out of the park in their career, or any combination thereof. Fortunately, my career in academics had LOTS of these success stories (side note — if this sounds like you and you’d be willing to answer some email question, don’t hesitate to reach out as I’d love to do a few more of these and help promote your accomplishments). Today, I’m going to share one with a personal finance focus that incorporates simulation analysis and some pretty sophisticated modeling/statistical techniques to answer the age-old question of “Do I have enough money to retire without being forced to live on Ramen noodles?”

You can go to the website — Honestmath.com — and check it out for yourself. It’s free to use, allows you to adjust several assumptions, and provides information about the what/why behind their model. I HIGHLY recommend doing so.

I’m going to let Khalen introduce himself in a minute. However, before that, I just want to say that students like him (and again, there were several such individuals every year) are what made being a teacher rewarding. One of the traits I remember learning on multiple camping trips with my parents growing up was that when it was time to pack up, you should try to leave the place a little better than you found it. Khalen does this. On multiple occasions, he come back to my classes to share his insights into getting his career started. Strangely enough, these classes generate far more student interest when a successful professional is talking, than when the professor is droning on about careers. From the time he first mentioned developing this project to releasing it to the public, it was easy to see the passion for both overcoming the challenges along the way as well as getting a product out there which will help people visualize their route to retirement success. Thanks to Khalen for agreeing to participate and best wishes to him, his family, and everyone behind Honest Math going forward!

First off, can you introduce yourself and give us an overview of how you ended up in finance?

I’m Khalen Dwyer. By day, I provide financial advice and consulting services to state and local governments, which primarily entails helping public entities raise capital in the municipal bond market. Last year, I founded HonestMath.com, a software project focused on developing powerful and affordable financial planning tools for investors and advisors. I live in Overland Park, Kansas with my wife, Whitney, and our children, Charlie and Alice.

I first developed a serious interest in finance and markets after taking an economics class in high school. I chose Pittsburg State to pursue this interest because of its affordability and proximity to my hometown of Fort Scott, Kansas. I graduated with a degree in finance in 2010 and earned the Chartered Financial Analyst (CFA®) designation in 2017.

What sparked your interest in developing this simulation project? How did you find partners with the skill sets and interest to join you on developing this simulation?

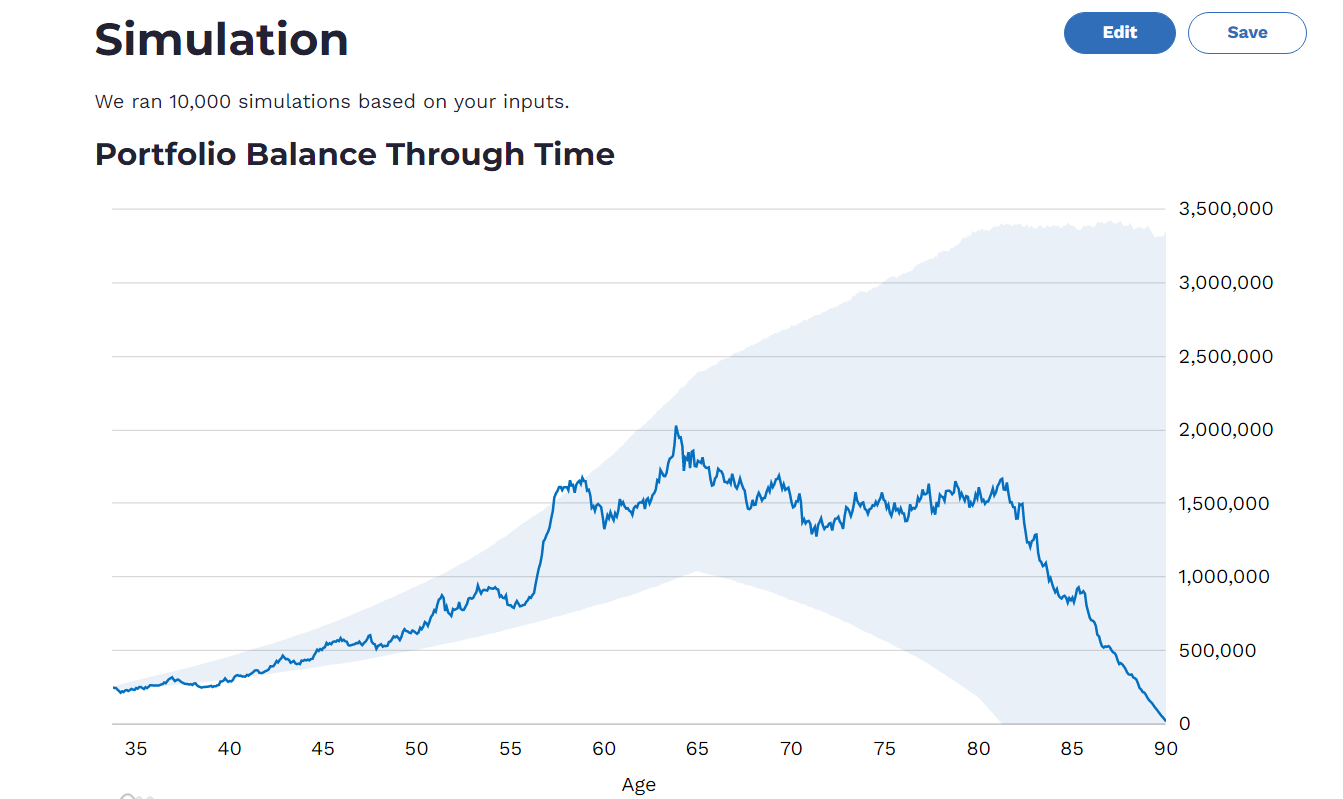

I was introduced to Monte Carlo simulation in one of your classes actually, though I forget which one.1 We were tasked with developing a spreadsheet model to simulate the investment performance of a retirement fund and the economic implications of certain tax-advantaged accounts. I’ve developed several models for personal use in the years since. As I refined these models over time, they evolved from nifty spreadsheets into robust financial planning tools that, in many ways, were more capable than anything I could find online.

A neighbor and friend of mine is an IT leader for a large wealth management firm headquartered in the Kansas City metro. I showed him one of my models last year, and we began discussing the possibility of converting it into a web application. He introduced me to some folks in his network with expertise in programming, web development, and user-interface design. Nearly a year’s worth of nights and weekends later, and our introductory simulator is up and running.

What differentiates your product from the competition?

Software programs with serious portfolio simulation capacity tend to be costly and reserved for professional use. There are a number of competitors offering affordable planning software for DIY investors, but these tools tend to lack serious analytical power. Among these, only a handful offer something resembling Monte Carlo simulation, and the implementation isn’t particularly compelling. The manner in which these platforms present simulation results and describe their methodology raises questions about the integrity of the analysis.

The Honest Math simulator distinguishes itself in many ways:

It’s free: unlimited portfolio simulations for anybody at no cost (for now).

A professionally designed user interface that is modern, sleek, and simple—no advertisements or clutter.

A “fat-tailed” random sampling process capable of replicating the extreme volatility that markets occasionally exhibit in real life (e.g., March 2020). This is a particularly valuable feature; almost all portfolio simulators used today—including professional grade systems—do not model fat-tailed returns. This renders these systems incapable of replicating market shocks like we witnessed during the start of the pandemic, no matter how many trials they run.

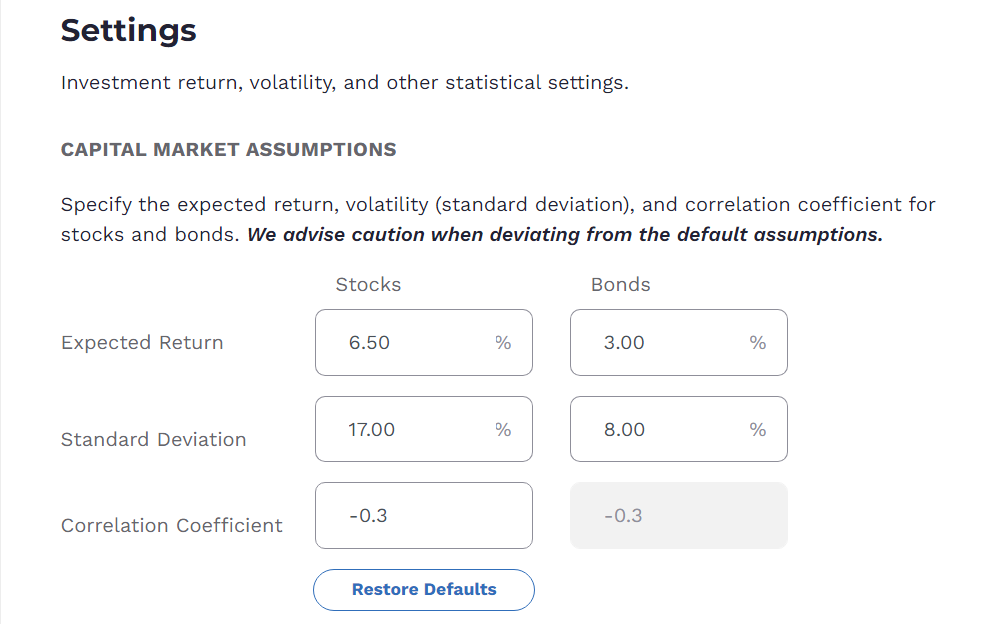

Fully customizable capital market expectations and enhanced statistical settings.

Capacity to incorporate multiple retirement income sources, tax considerations, irregular portfolio withdrawals or contributions, and “Black Swan” events.

Flexibility to accommodate multiple investment allocation stages for “glide-path” portfolio rebalancing over time.

Monthly calculation periodicity, which facilitates more realistic portfolio contribution and drawdown patterns.

A partnership with Amazon Web Services (AWS) to leverage the power and speed of the largest on-demand cloud-computing platform in the world. Honest Math currently models 10,000 trials for each simulation, which requires generating tens of millions of calculations and random variables each time a user runs the model. The computational power of AWS is instrumental in executing this workload in a fast and cost-efficient manner.

We sincerely respect user privacy; we do not store or sell user information. In fact, we don’t even see it. For convenience, the simulator’s “Save” function is capable of storing information in the user’s web browser, which allows the user to sign-in and sign-out from the same device without losing their assumptions. However, if a user clears their browsing history and cookies, all simulation settings are permanently erased and returned to their default values.

What are two to three important things that you think most people aren’t aware of with respect to simulations and why are they important?

First, people should simply be aware that simulations exist, and that they’re accessible and superior in a number of ways to traditional straight-line (deterministic) financial planning methods. Consistent and stable investment returns don’t exist in reality, and using models that assume otherwise can be wildly misleading. Simulations allow us to factor in randomness and volatility—two things that exist in real life—to illustrate a range of potential outcomes, the breadth of which is often surprising.

Second, many popular tools use historical investment returns to “back-test” a financial plan or “boot-strap” portfolio simulations. Unfortunately, these methods aren’t as helpful as they might seem for financial planning purposes. This is because historical investment performance is dependent upon the environment in which it occurred, and the factors characterizing the environment (e.g., interest rate levels and other macroeconomic fundamentals) change over time.

For example, J.P. Morgan’s most recent capital market assumptions forecast a compound annual return of just 4.1% for large-cap U.S. stocks (e.g., S&P 500 Index) over the next 10 to 15 years. This is in stark contrast to the 10% to 12% historical returns pop-finance personalities often cite when setting expectations for future returns. For this reason, performing forward-looking analysis based on historical investment performance could result in grossly optimistic results and a false sense of security.

One of the behavioral biases out there is the planning fallacy, which essentially says we tend to be way too optimistic in our expectations of how long it will take to finish a project. Did you see that in developing this project?

Yes, although there was a lot of goalpost shifting on my part, which contributed to numerous timeline extensions. As the project progressed and the size of our team grew, so did our capacity for adding features, design enhancements, etc. I raised the bar—or simply changed my mind—a handful of times, which resulted in delays.

It’s one thing to change direction when working alone in a spreadsheet. I’m all too familiar with how long it takes to get a model to behave and look the way I want it to—dead ends and do-overs are factored into the process. However, the trial and error process is much more painful on a group software project: “Hey team, you know the countless hours you’ve spent developing X, Y, and Z? Well, it’s not going to work the way I envisioned. We’re heading in a different direction…”

To use a metaphor, the steel required a lot of pounding to create the sword we see today, but the plans for the sword changed frequently and ultimately tripled in size and complexity.

What were the two biggest challenges you encountered in developing this project?

It was particularly difficult to lead a team and delegate tasks across a variety of tech disciplines in which I have no expertise. My background is in finance, not software, so I was starting with a blank slate. And although I often know—or think that I know—what I want to create, I don’t always know how to ask for it, whether it’s practical, or what it’s going to cost in terms of time, energy or money.

Researching stochastic processes and refining the algorithms that underpin the simulation was also a challenge, although one I enjoyed. Almost all portfolio simulation software used today relies on a purely Gaussian framework by modeling returns (or prices) with a normal (or lognormal) distribution. But these models fail to replicate the extreme price movements we occasionally see in reality, particularly in equity markets. It was important to me that our process for sampling random investment returns (a) improved upon the classic methodology, and (b) was supported empirically. The method we use to simulate fat-tailed stock returns includes a stochastic process used in academia to replicate real-world volatility.

Where do you see the market for your product going over the next couple years?

I’m particularly passionate about empowering individual investors, which is why I intend to keep a limited version of the simulator free to use. The personal finance industry has a lot of room for improvement, and I think giving people direct access to serious planning tools is one way to encourage change for the better. I also believe there is an under-served and growing market of folks that take a hands-on approach to personal finance. I think this market will continue to expand as the generations behind us—which are growing up with global knowledge at their fingertips—come of age. For better or worse, teenagers today are trading stocks (and options) from their bedrooms, and an acquaintance recently told me his teenage daughter was inquiring about opening an IRA. Over the long term, I think the general public’s appetite for sophisticated financial planning tools could be surprisingly large.

We’ve also had conversations with a few advisors/planners throughout the development process, and early feedback has been very positive. The simulation capacity of many costly professional-grade programs is surprisingly limited. We think the simplicity, power, and superior modeling framework of our simulator would make a valuable addition to an advisor’s existing software suite. Our tool could be especially useful for illustrating a point about assumption sensitivity or for running quick scenarios for a client—especially if doing so in the traditional software package is more cumbersome or less robust. In turn, the client could tweak the advisor’s scenario by directly accessing the simulator at home and playing with the assumptions in their free time.

I’m also excited about a potential white-label service that entails opening up our API to allow individuals or institutions to host our software on their website. We believe our simulator is superior to the existing products available online for free, and it would make a substantial upgrade to popular tools currently found on high-traffic personal finance and banking websites. Our technology stack would make this relatively simple to implement—we’re entirely cloud-based, and the AWS framework facilitates effortless scaling.

Lastly, I could foresee a variety of applications for our simulator in research and academia, especially once we’ve equipped it with detailed reporting and data-exporting functionality.

In short, we’re confident there are a number of ways to get traction among individual investors, finance pros, and folks geared toward research. We’ll learn a lot over the next several months in terms of the types of folks that gravitate to our product and the feedback we receive from users. In the meantime, we’ll keep our options open while continuing to build the best product we can.

How much knowledge regarding finance, investments, taxes, etc. do you feel that the average person would need to be able to successfully use your product or is it something targeted towards financial advisors?

We think that most people actively seeking out a tool of this nature will find that it’s relatively easy to pilot the controls, especially after playing around with it for a bit. The majority of the inputs require basic information (e.g., age, retirement status, savings, estimated living expenses, etc.). We plan to make resources available on the app or website to assist folks with navigating the trickier assumptions, like income taxes, social security benefits, and portfolio allocation.

The “Settings” tab will be the most intimidating part of the tool for most non-professionals (and perhaps some professionals), but changing anything on this page is completely optional. Although we encourage most users to maintain the default settings, we popped the hood to give fellow finance nerds the flexibility to adjust the statistical parameters to their liking.

What three books, podcasts, or individuals would you say have provided the biggest life lessons (they don’t need to be about finance) to you and why?

Non-Fiction: Fooled by Randomness by Nassim Nicholas Taleb. It’s an important book about the grossly underappreciated role that randomness plays in life.

Fiction: The Brothers Karamazov by Fyodor Dostoevsky. I’m listing this at the risk of sounding pretentious, but I’d be remiss not to include it. It’s a long read, but it really is a wonderful book about life and people being people.

Podcast: Making Sense with Sam Harris. This podcast is full of thoughtful observations, analysis, and interviews covering current events, important problems facing society, and life in general. Harris offers something increasingly valuable in the current climate: articulate, rational, and sincere perspectives on highly charged issues. I think Harris’ work on the nature of free will is especially thought-provoking, and it raises important ethical questions for both individuals and society at large.

It was Investments class with an “infamous” spreadsheet project that I put together.

This is a great tool. Thank you! I'm going to recommend it in my retire.substack.com newsletter and in the Retire in Bali Facebook group soon