Liberty’s Highlights

I’ve decided to give away a second one-month subscriptions to Liberty Highlights. Last week, we did the first, this week we’ll do the second. If you are interested, please send me an email or reply to this forum and I will randomly pick a winner. I’m going to mention this again in a minute as I’d love to hear from you regarding the content of the past five episodes. Here is the random drawing for this week’s drawing.

If you didn’t win, jump in for the next one!

Down Time

I’m also ready for a small break. It could be a month or it could be two. However, I’m running out of stuff to talk about (apparently it’s not like a normal semester where I get to just repeat stuff on a regular basis 🤣) and feel like it’s time to rest up (and watch some football).

Disclaimer — This is an informational process and is not designed to tell you whether or not you should buy Gladstone Land Corporation (LAND 0.46%↑). Instead, it is designed to show you how I would go about the evaluation and what questions I have. DO NOT USE THIS SERIES TO MAKE A BUY/SELL DECISION!

Note that this is a different, multiple part (maybe too much) attempt to look closely at a company. Please let me know what you think and feel free to offer suggestions for improvement.

Second Quarter Overview and Recap

It’s time to wrap up our Gladstone Land review with a look at the 2nd quarter of 2022 (which ended in June) and close with a “what we learned” overview. If you liked this series, please let me know. We can follow it up with a review of Howard Hughes Corporation and I can do these more frequently. If you didn’t care for it, let me know that as well and we can return to regularly scheduled programming. Remember that I’ll be gone for a month or so, but hopefully there will be some feedback to help provide some guidance. Feel free to send an email or, better yet, reply in the comment section.

Conference Call Overview

You can see the conference call transcript here if you’d like to follow along. I’m going to go through this as it unfolded instead of picking highlights and discussing them out-of-order. Unless otherwise stated, assume the quotes come from David Gladstone.

We currently own over 115,000 acres of farmland in the United States and 169 farms. And in addition to that, as some of you will remember, we have 45,000-acre feet of banked water. An acre foot is equal to 325,861 gallons of water. That pencils out to about 14.6 million gallons of water that we have stored in the ground. And together, those 2 are valued at over $1.5 billion for this quarter end.

This refers to the total farm net asset value of $1,501,880,000 from their 2nd quarter update which worked out to $15.60 per share.

Our farms are in 15 different states, and more importantly, they are in 29 different farming areas. Farms continue to be 100% occupied and leased to 90 different tenant farmers, all of whom are unrelated to us. And the tenants on these farms are growing over 60 different crops.

This is an important aspect of Gladstone Land in that it may not be truly diversified geographically (remember that California and Florida account for the vast majority of their land), they are spread out across crops and growing regions. Therefore, they do provide effective diversification in general. Also, their farms are 100% occupied. This speaks well for their ability to generate dependable cash flows from their assets.

We are much more selective in the type of farms that we're looking to buy. In light of the uncertainties in the economy, we believe it a good time to be more conservative with our capital. The team purchased 5 farms of about $60 million this year.

One of the major purchases was the $37.3 million purchase of vineyards in Washington and Oregon (1,317 acres of farmland) for $28,322 per acre.

We continue to be able to renew all expiring leases without incurring any downtime on any of the farms.

This is another positive sign that speaks well of their management team and advisory board. When you are making your money from leasing farms, you want to be able to renew leases quickly and easily. It appears that Gladstone Lands is accomplishing that goal!

The latest headline inflation number of 9.1% shocked us all, obviously. It is the highest in nearly 43 years. In the category though, which is called food at home, that category was up 12.2%….Farmers are adjusting to the changes in our economy as many of their input costs are increasing. First of all, the banks have increased the interest rates on all these lines of credit that farmers have, which they draw down when it's time to plant their crops. And then they also draw down additional funding from the banks for harvesting cost. And then, of course, there's all kind of things that they do during the year that they need extra money before they start harvesting. Farmers are also paying much more for fertilizer.

In other words, while increasing price for farm produce is good for farmers, it is being offset by increasing farm production costs. If the farm produce increases by 4% per year while farm production costs increase by 2%, this is great. On the other hand, if farm produce increases by 8% while production costs increase by 10%, this is not so great. Farmer’s need to make money in order to continue to engage in the business.

Currently, we have 2 farmers who are slow on their paid rent. It's below 3% of our rents.

This is not surprising given the inflation in the farming community. Remember that they have 90 different farmers, so this represents about 2.2% of their farms.

In the meantime, we're looking for ways to adjust our overall cost of capital to better match the changes that we're seeing in the farmland acquisition market. Our issue is that our preferred stock and our borrowings have both become expensive for current farmland prices and rents. We have lines of credit. We're not using them. We've left them all fallow and just no reason for us to draw down money and put it to work if we can't put it to work with some spread from what we're paying to the money that's coming in. We're currently discussing internally a strategy for better managing our cost of capital. And if we make some big changes, we'll be back to you on that.

This is an important warning as it illustrates that one of the big advantages of Gladstone Lands is the cost of capital relative to Return on Invested Capital. Their costs are rising relative to what they can earn which reduces the potential income of their operations. This is likely one of the reasons why the stock price has dropped from almost $42 to $23 over the past few months.

During the second quarter, our team acquired one farm in California for about $25 million. In addition, right after the quarter end, we acquired 4 more farms in Washington State and Oregon. We paid about $37 million for that. Overall, the initial cash yields to us on these investments is about 6%. In addition, all the leases on these farms contain certain provisions such as participation rents or annual escalations that should push that figure higher as we move forward.

Keep in mind that the Series B, C and D Preferred is trading to yield about 5.0-6.0%, so after expenses, there isn’t really a profit immediately on the new purchases. However, the participation rents, annual escalations, and increasing property value (assuming it does continue to increase) should generate profits before long. Also, some leverage could help boost returns a bit.

On the leasing front, since the beginning of the second quarter, we renewed 2 leases, which in total are expected to result in increase in annual rent and operating income for us. About $179,000 based over the prior leases that we had on the property.

And looking ahead, we only have one lease scheduled to expire in the next 6 months, and that makes up less than 1% of our total annualized lease revenue. We are in discussions with potential tenants for this farm, and we aren't currently expecting any downtime on that.

So leasing activity is not very active, but appears to be going smoothly.

The next paragraph is a discussion of the drought out West in California (it is real), but is not hurting their properties at the moment.1

All of our properties in California continue in the position where the farmer has enough water to complete the current crop year. Of course, we never know what next year is going to look like, but water remains a premium out West.

There is also a discussion of property values not necessarily reflecting the current market pricing.2

The appraisal values aren't moving very fast though, as quickly as I would like them to pick up the current prices we're seeing…Their values can be sometimes lagging quite a bit.

The final bit is about their ESG (Environmental, Social, and Governmental) approach in that they are in the process of adding some solar/wind arrays on their properties. However, he (legitimately) is in a position where his first priority are the tenants (who lease the property). This makes perfect sense in that you need to be able to convince the tenants that the environmental push is to their benefit, not their detriment.

We always want to be careful that we enter into agreements that aren't going to disturb our tenant. Well, maybe a small disturbance, but tenants currently on our farm because that's our primary business partner is the tenant. Not the guy who's going to put some solar arrays on the property.

Operating Updates

We move from David Gladstone to Lewis Parrish for some operating information.

During the quarter, we received about $5 million in loan proceeds. Those proceeds are expected to bear interest at an effective rate of 2.89%, which is fixed for the next 5 years. On the equity side, since the beginning of the second quarter, we've raised about $70 million of net proceeds from sales of the Series C stock.

The cost of debt is relatively cheap (2.89%), but the ratio of debt to preferred is probably more important. If the firm raised $75 million in financing, but only $5 million in debt, that works out to 6.67% debt financing vs. 93.33% equity financing. Unfortunately, the equity is higher (we don’t know the price, but assume it is 6.0%), that would bring their cost of capital to 5.79% (an approximation because Series C is not quoted).

Numbers from the 2nd Quarter include:

Net income of about $613,000

Net loss to common shareholders of $3.9 million or $0.112 per common share (remember that these are not similar to earnings from a company)

Adjusted FFO for the second quarter was approximately $4.5 million ($0.129 per share) compared to $6.4 million ($0.185 per share) in the first quarter

Fixed base rents increased by $320,000, core operating expense decreased by about $1,000,000

Sixty-one farms were valued showing an increase of about $500,000 from the previous year. This lead to their NAV coming in at $15.60

Their loan-to-value ratio on their net holdings is 38%. Of the debt, 99% are fixed rate with the rate fixed for the next 5 years. The current yield is 3.26%

They currently have about $55 million in loans coming due over the next 12 months, but only about $24 million is likely to need paid. They currently have $135 million in purchasing power, so debt due is not a problem

Their dividend is set to $0.0456 per month. While they make a point of saying the dividend has been “raised” 27 quarters of the past 30 quarters, the raises have been pretty small as it has gone up by 52% over that time frame.

Note the slow growth of dividends from 2018-2022. Dividends grew rapidly during the first 3 years before slowing dramatically over the past 5 years.

Question and Answer Session

Next we go to the Question and Answer session. However, before that there is a general commentary by David Gladstone.

The NCRI Farmland Index, which has about $14.6 billion worth of agricultural properties, including all of those that we've listed with them so that they have ours as well as others in the business, have been averaging about a 12.6% overall return over the last 20 years with no negative years. As you may know, some of the indexes have gone negative during the year. This is higher than both the S&P Index and the overall REIT Index, both of which have had 3 or 4 negative years in the same periods of time. Versus 0 for Farmland Index.

This is a little misleading in that Gladstone Land had negative returns in 2014-2015 and is on track for one in 2022 (although there is still plenty of time that could change).3 Therefore, while farmland itself has exhibited no negative return, Gladstone Land has done so in 3 of it's 10 years. Granted, it is still up by 133% over the time frame, however, that does pale in comparison to the S&P 500 which is up 215% over the same time.

One, it's similar to hard assets like gold. After all, farmland is mostly just dirt. And that's an intrinsic value because there's a limited amount of good farmland and it's being used up. It's an active investment which cash flows come in to investors. We expect inflation, particularly in the food sector to continue to increase, and we expect the values of the underlying farmland to increase as a result.

I don’t disagree with either of these two statements, which is why I do have exposure to farmland in my portfolio. The key is to figure out which is the best way to gain exposure to the asset class.

The first question is what has happened to the price of farmland and the availability of farmland? The answer is that it is up 20% (which I’m guessing is a ballpark estimate) in the last year. As for availability, he answers as follows.

If you're in California or Florida, there's not that much in the way of any auctions. We've been to one that I remember in the last 20 years. It's a fairly dominant marketplace for those who will figure out what might be for sale. And so that's what we do. We go to the farmers, talk with the farmers and spend time with the farmers. We get our best chances is when one of our farmers will call up and say, Joe next door is thinking about selling his farm, but I don't have the money, would you buy it and let me rent it? That's where we've concentrating on talking to farmers. I think our guys are on the phone with somebody every day trying to figure out what might come up. And when it comes up, there's at least a 50-50 chance that will be priced in a way that we won't be able to compete because our cost of money is too high. As a result, we're in touch with a lot of the people there. can't give you, Rob, I just can't give you much in the way of what a farm would go for today, but we're buying them. We spent $37 million at the end of the year to buy farms in the State of Washington and in Oregon.

Let’s break this down a bit. Essentially the answer is there is not a lot of available farmland and it takes quite a bit of effort to broker a deal. There is some availability, but it is largely overpriced and out of the range at which Gladstone Lands is willing to pay. Part of that is due to their cost of capital. However, they do still do deals when conditions present themselves.

The next question (still the same analyst) asks about wind turbines and solar panels. This was mentioned earlier in the call. The answer is largely that they do put them in when it makes economic sense. However, it is not clear that David Gladstone is a huge fan of the environmental benefits of renewables.

I think at the end of the day, when you look at these turbines and all of those, those are wonderful ways to capture the wind and capture the sun, but they're not going to take over for quite a while as a mainstay for us or anybody else to generate electricity.

The next question had to do with participation rents. These are rents in which Gladstone Lands gets to participate on the upside of the harvest assuming it generates enough money.

I think we have about 40 farms that have participation rent components. I'd have to go back to the 10-K to see what it was for '21. But as I said, we are expecting it to be up, and that's largely a factor of a lot of the farms we purchased recently. They're either coming into full maturity or that participation rent component is now coming online for the first time this year. Or just it's additional farms we bought in the past couple of years.

Does this answer concern anyone? First, according to the 10K, there are 35 farms with participation rents. Maybe they are including new purchases, but the difference between knowing how many farms pay participation rents is 35 or 40 seems meaningful.4 Also, the income statement shows that for the first 6 months of 2022, the participation rental income was a mere $20,000 out of $40,210,000. That is 0.05%!

Combine that with the answer either a lot of farms “we purchased recently” or farms “we bought in the past couple of years,” makes you wonder how much time the CEO/President put into preparing for this call.

The next question comes back to wind turbines and solar arrays. David Gladstone replies

Because stockholders, at least some of them, are demanding that they move in that direction. We are getting better deals than we got 2 years ago and I think it will keep going that way. Probably cover the whole nation with wind power one day. We'll be like the guys in Europe who are putting up all of those things.

And I think they'll, quite frankly, I think they'll put more wind turbines up off the coast like in Massachusetts where you can see them from the beach and people are excited about that. And I think it's going to be a while before we get a lot. I don't know what it is, is it 9% now that we've got wind or solar that's producing for us? And of course, we're one of the few nations that do that kind of stuff. As a result, there's other countries where they're still burning lots of coal. Like China, I think they open up a new coal mine every week. As a result, I don't think we're going to do much for the world in terms of shutting down the use of all of these things that put so much dust in the air.

It’s a text transcript and I’m not listening to the actual call, so I might be missing the tone of his comment. Maybe he seriously is a fan of alternative energy. However, I get the impression that this is more of an inconvenience that they are dealing with rather than a chance to improve the energy situation (which may be valid as I don’t know the economics). Alternatively, this seems like a positive comment

Usually, they can do it in an off-season, so it doesn't disturb them and that works. And during the season, unless the wind is really making a lot of racket with the wind mills, it's nothing. You don't want to put them too close to houses because people don't want the noise. It's a developing area, and like all development areas, we don't know what's going to happen. We know there will continue to be pressure to move more and more toward those and hopefully we're the beneficiary of that.

The last question is on what is expected with rents and pricing going forward. His response is positive saying that he expects “We'll get many more increases than we will decreases. As a result, I think you should be bullish on that area of increasing rents.”

Beta and Past Performance

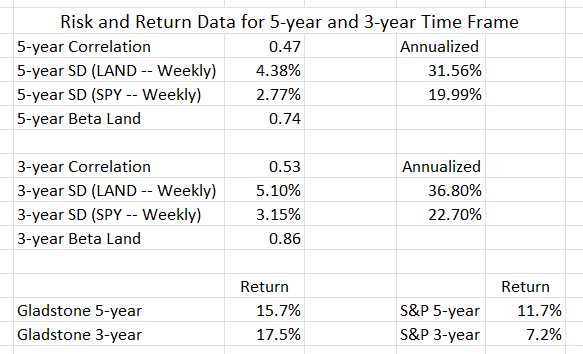

One statistic that is mentioned in Gladstone Lands presentations is the performance of the NAREIT Farmland Index. For the last 20 years, the Farmland Index has earned a higher rate of return than the S&P 500 (12.6% vs. 11.1%) with less risk (7.4% vs. 17.1%). These numbers are likely valid. However, the cost of managing a farmland REIT (like Gladstone Land) is going to reduce returns and increase risk. For the last 5 years, the risk of Gladstone Land has been much higher than the S&P 500 (31.6% vs. 20.0%). The same is true for the past 3 years (36.8% vs. 22.7%).

From a return perspective, the return on the Gladstone Lands stock price over the past years tells a different story. It has been higher than the S&P 500 over the recent past (15.7% vs. 11.7% over 5 years and 17.5% vs 7.2% over the past 3 years). The correlation of Gladstone Lands to the S&P was 0.47 and 0.53. Beta was less than one in each case with 0.74 (5-year) and 0.86 (3-year). This implies that LAND is less risky than the market by a small amount over the recent past.

Recap of Gladstone Land

Again, I want to stress that this is MY opinion on Gladstone Land. It may be too conservative or too aggressive for YOUR investment approach. Do not try to apply my views to your investment strategy. Heck, as I’ve mentioned a few times, the best strategy is to invest regularly in an ETF/index fund in your IRA (Roth or Traditional) or 401k (Roth or Traditional). Save as much as you can afford and only look at the account about once a year to rebalance to your preferred risk. Your 30-minute per year plan will provide plenty of time for hiking, playing reading books, playing golf or working on your Salsa dancing (or any of 100 other hobbies you may be pursuing). Only if you enjoy brain damage should you try to manage your own investments.

Advantages of Gladstone Land

Probably the major advantage to investing in Gladstone Land is access to farmland in your portfolio. There are other ways, but only two farmland REITs trade publicly that I’m aware of (the other being Farmland Partners (FPI)). So unless you have the wealth/income for personalized investments this is an easy way to get exposure.

Taking it one step further, Gladstone Land does provide diversified exposure to more permanent crop (as opposed to annual crop) farms. These offer a little higher return on average (year to year fluctuations aside).

Diversification. By buying Gladstone Land, you do not have a major concern about something happening to a single farm. They have over 160 individual farms and perform diligence on both the farmland selected and the tenants. While it is hard to argue that Gladstone’s advisory team provides extra assurances, it is also hard to argue that it doesn’t provide meaningful protection for investors.

Performance has been good over the past 3-5 years. If you look at total returns (even with the tough year that Gladstone has had this year), they are handily outperforming the S&P 500 in terms of return with slightly less than average risk. Granted, a portion of that is due to good conditions for farmland. Rates were low for awhile and as rates rose, so to have food prices. Unfortunately, we don’t know what the next few months (or years) are going to look like.

Disadvantages of Gladstone Land

Advisory fees are high and there are significant agency relationships. Not only does Gladstone Land charge relatively high incentive fees, but they also have cross-connected relationships, lack of shareholder influence on the board, and other potential agency conflicts. While they may be above-board on all these issues, the lack of ability for shareholders to do much opens up risk.

It is a competitive market. Farmland is not a unique product that Gladstone Land is running. It has an active secondary market with many institutional players. Therefore, there is unlikely to be a sustainable advantage provided by Gladstone’s advisory board. Instead, you are likely to earn farmland returns less the management costs of running the company (base management fees, incentive fees, overhead costs, labor expenses, etc.). If farmland itself earns a 12% return, you are likely to average a 8-10% return. If farmland earns an 8% return, your are likely to average closer to a 6-7% return. This includes the leverage component which is helping to boost your returns.

It likely got a bit ahead of itself. While I believe that the NAV is likely understated, the NAV went from $14.31 in 2021 to $15.60 in the last 2 quarters (about an 18% return). If the true NAV is somewhere between $15.60 and $20.00, this still places Gladstone as a bit overvalued. Also, the FFO per share for the first 6 months of 2022 is $0.33/share. The stock price is at $22.98. This means that even if the next 6 months generates $0.40/share, the stock price is trading at 31.5 times “cash flow”. Granted, maybe it grows faster, but it is still pricey relative to both NAV and FFO.

Complex financing. While preferred and debt are common among REITs, it does make it harder to understand the company’s financials…especially when one of preferred share classes is not publicly traded. They also have several pieces of debt. While they do provide great information on this, it is tricky to understand and follow along. It also gets confusing as FFO overall can go up a lot faster than FFO/share (again, consider 2021 where FFO increased at a 45% rate while FFO/share growth was just a touch above 6%).

Takeaway on Gladstone Lands

My takeaway is that Gladstone is a mediocre investment. I like having some farmland for the diversification, but keep in mind that you aren’t owning just farmland. You are owning a REIT that OWNS farmland. The payoff pattern is quite a bit different. Over 10 years, you’ll probably earn the return of farmland less about 2-3% in operating expenses. Your risk will be a little higher as the REIT will move with the S&P a bit more than normal (due largely to psychological issues). If it had no diversification benefits, I would not own any Gladstone. I actually own far less of it due to my AcreTrader investments (which offers a slightly lower cost of ownership). Would I purchase more if the price point dropped down to $15-$18 and the business stayed stable or improved? Sure. However, the current price is too high to commit more capital.

Please Leave a Comment

I mentioned this above, but let me close with a final request. Did you like the in-depth look at a single company? Are there things you would like to see me do differently going forward or follow the same basic framework? If you’re indifferent, that’s fine. However, if you have a preference, please take a second and leave a comment! This will allow me to know how to direct the discussion going forward.

This is according to David Gladstone. If you remember last weeks comments on the principal-agent issue, there are reasons for him to paint this in a positive light whether intentional or not.

This is another potential principal-agent issue as the CEO/President of Gladstone Lands would want property values to appreciate faster (raising NAV). It also could be valid complaint. The issue is more that we don’t know 100% what the true story is and we are getting a version from someone with a vested interest in telling a positive story (which could very well be accurate).

Gladstone Land’s 2014 return was -31.4% and their 2015 was -16.1%. They currently are on pace for a -31% return in 2022.

The 10Q also lists 35 participation rents. There were new properties purchased since then, but I doubt if 5 have participation rents.

Thanks, I enjoyed your commentary on the company presentation. Play by play version is a nice approach.

Would love to remain in the drawing! Great read today!